This article was last updated on November 11, 2024

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Backtracking on the Cashless Society and Strengthening the Right to Pay with Cash

With the vast majority of central banks around the world researching, experimenting with or implementing a new monetary reality as shown

….recent developments in Norway are quite fascinating.

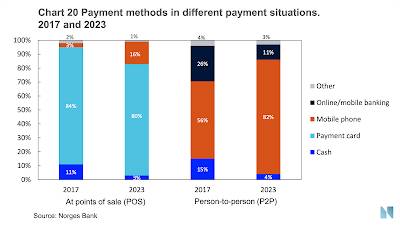

According to Norges Bank, Norway’s central bank, in 2022, only 3 percent of Norwegians used cash when making a purchase at a point of sale (i.e. a physical store) as shown here:

In contrast, Norway has the second highest annual use of payment cards among selected nations with an average Norwegian using a credit card or equivalent 531 times in 2022 as shown here (graph data current to 2021):

Rather surprisingly, this was announced by Norges Bank on its website slated to take effect on October 1, 2024:

According to the Financial Contracts Act, consumers have the option to pay with legal tender (i.e. physical bank notes and coins) as long as the amount owing is not greater than 20,000 kroner ($1850 US).

This is being enacted for two reasons according to Justice Minister Emilie Enger Mehl:

1.) as a means of providing security for those consumers who are reluctant to used digital payment solutions.

2.) as a means for preparing Norwegian society for emergencies such as prolonged power outages, system failures or digital attacks against payment systems.

Here is a quote from Ms. Mehl’s press release dated August 3, 2024 when the issue was being discussed (with my bolds):

“The government’s task is to ensure society’s preparedness. Relying exclusively on digital payment solutions increases the vulnerability of society, and in certain situations this can contribute to putting important social functions out of play. Preparedness is an investment to counteract vulnerability and safeguard important functions in society and the needs of the population.

If no one pays with cash and no one accepts cash, cash will no longer be a real emergency solution once the crisis is upon us.

As a society, we need an alternative if it becomes necessary, and today cash is the only alternative that is easily available if digital payment systems fail. In addition, companies also make themselves vulnerable if they do not accept cash in the event of a crisis, says Mehl.“

I find it interesting that Norway has taken the approach that cash is a necessary “evil” to ensure the inclusiveness of all of its citizens which is rather ironic given that CBCDs are being sold to us as a panacea for those who are not in the banking system. As well, given the vulnerability of the digital payment grid as has been revealed time and time again as shown here:

….at least one nation is taking the approach that going completely cash-free is one of the stupidest things that a government and central bank can do.

Be the first to comment